When to do a Payment Adjustment

A Dues Payment Adjustment is done when you need to remove, adjust, or reverse a posted payment from a Member’s record. Examples: Incorrect Payment Amount, Bounced Check (NSF), Payment Posted to Incorrect Member Record.

Making a Payment Adjustment

- Go to Payment Adjustment under the Dues Processing menu.

- Do a Member Search and Select Applicable Member.

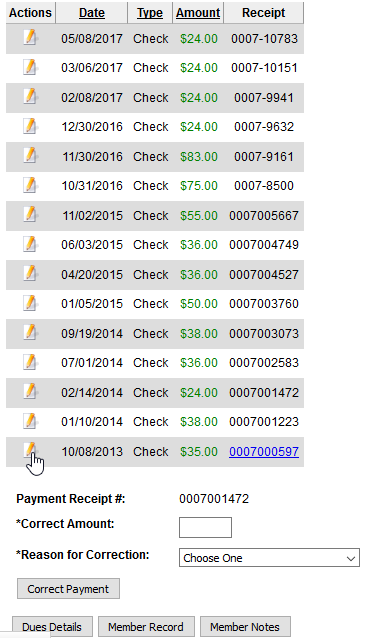

- A list of Adjustable Payments will appear.

- If a payment was adjusted to $0, it will not reappear.

- Click the Edit Action button (paper & pencil) once locating the payment to adjust.

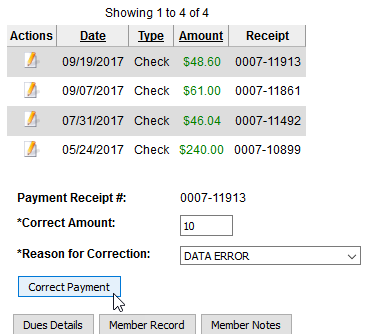

- Correction entry boxes will populate below the Payment History Table.

- Correction entry boxes will populate below the Payment History Table.

- Enter the Corrected Amount

- If the money was not actually received, the Corrected Amount should be 0

- Select a Reason for the Correction (this will display on Receipt).

- Click Correct Payment.

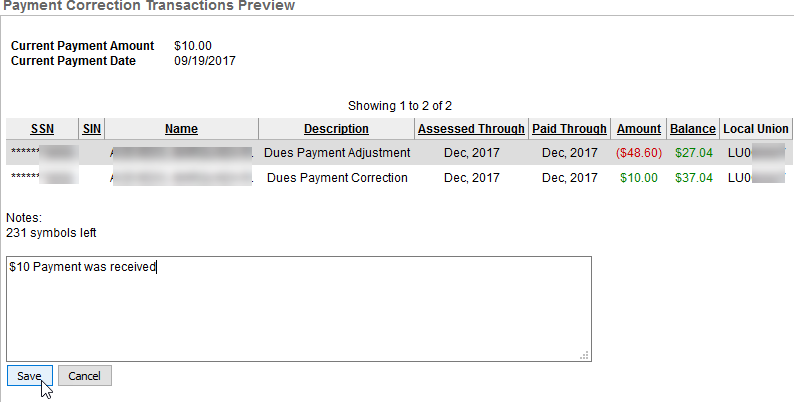

- The Payment Correction Transaction Preview will display the payment correction and the current Balance.

- There is an area to enter a Note for the Member. An example, “An adjustment payment was processed due to a returned Check (NSF). Please pay with money order or cash by the end of the month. Be sure to include the $25 NSF fee.”

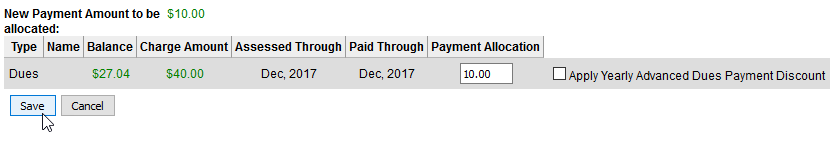

- Allocate the Payment.

- There may be more than one transaction/description to apply the payment. Other fees and/or Charges may appear here.

- There may be more than one transaction/description to apply the payment. Other fees and/or Charges may appear here.

- Click Save.

- Review the Payment Correction Transaction Preview.

- There is an area to add Notes to the Member’s Receipt.

- An Example note is: “Your check was returned as NFS. Please pay with a money order or cash by the end of the month along with a $25 NFS Fee.”

- Click the Save button after entering a message.